- Home

- Managed Services

- Cyber Security

- Blog

- About Us

We 365 Admin Support, just simplify your IT problems

Call for a free support. +91 96666 59505Platform Partnership

- Who We Help

- Shop

- Contact

- News

HIGHLIGHTS

Table of Contents

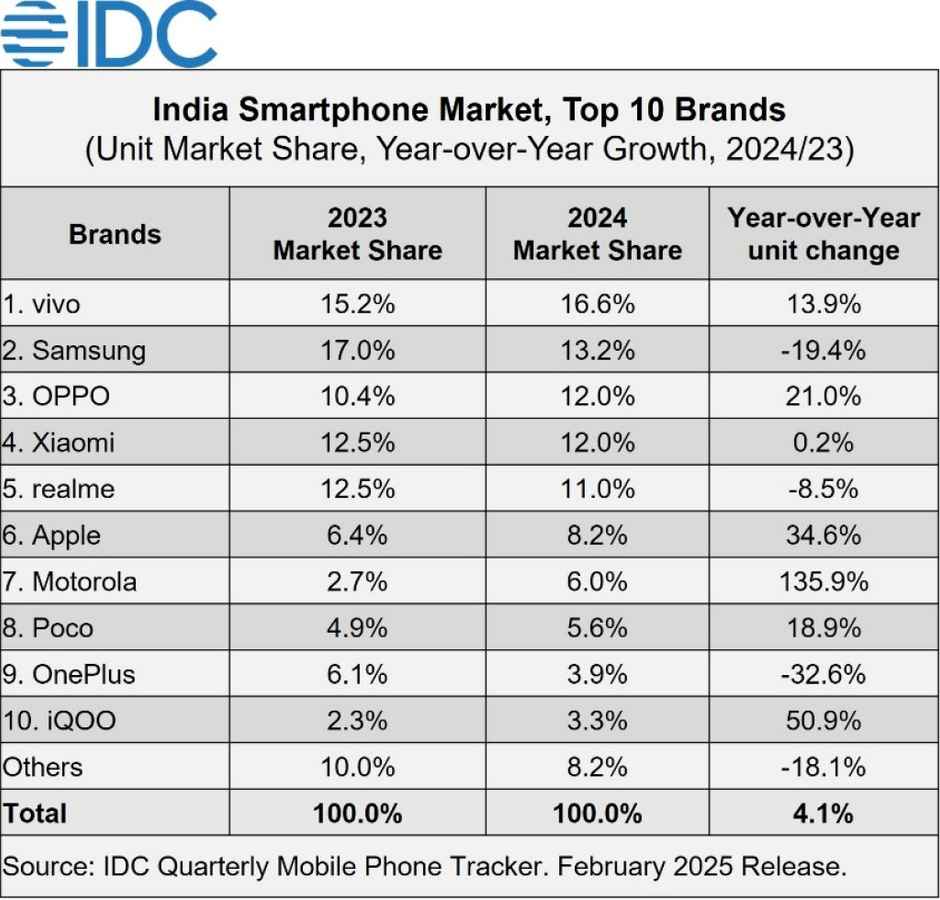

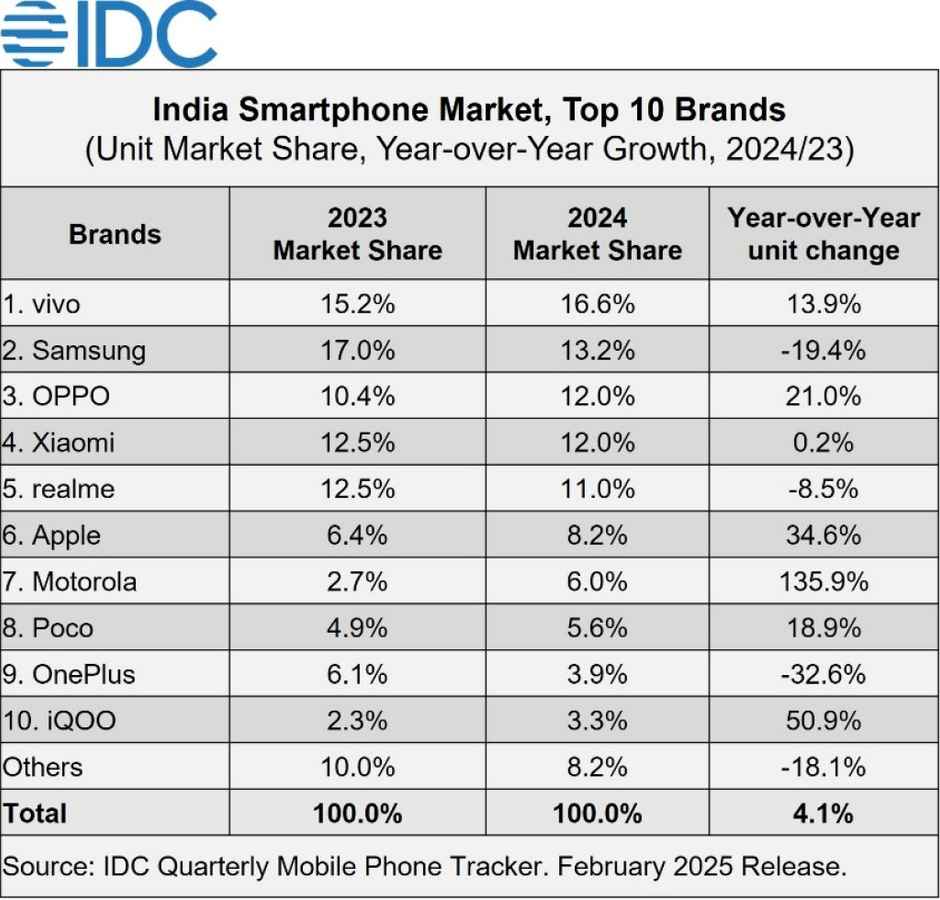

ToggleThe Indian smartphone market is poised for a year-on-year (YoY) growth of 4% in 2024, with anticipated shipments reaching 151 million units, as per the latest findings from the International Data Corporation’s (IDC) Worldwide Quarterly Mobile Phone Tracker. The report highlighted a robust 7% growth during the first half of the year, followed by a more modest 2% increase in the latter half.

The IDC report reveals that Apple made significant strides in the Indian market, selling a remarkable 12 million units, marking a substantial 35% YoY increase. This surge has positioned India as Apple’s fourth-largest market globally, behind the United States, China, and Japan. For the first time, Apple has broken into the top five smartphone brands in India, acquiring a 10% market share. The report identifies the iPhone 15 and iPhone 13 as the top-selling models in terms of shipments.

Examining growth by market segments, the premium category (priced between $600 and $800) saw a 34.9% increase in YoY sales, raising its market share from 3% to 4%. Meanwhile, the entry-premium segment (priced between $200 and $400) experienced an impressive 35.3% YoY growth, achieving a market share of 28%. Notable models that contributed to this growth include the Samsung Galaxy S23/S24 and the iPhone models 15, 13, and 14.

The uptick in sales during this year can be largely attributed to various factors, such as enticing post-festive discounts, extended warranty offers, and flexible financing options like No-Cost EMIs available for up to 24 months.

Also read: Doctor loses Rs 1.8 crores in stock investment scam: Tips on avoiding such frauds

A remarkable surge in the adoption of 5G smartphones is reflected in the shipment data, with 120 million units shipped in 2024. This elevates the 5G smartphone share to 79%, significantly up from 55% in 2023. The mass-budget 5G segment ($100-$200) has almost doubled in shipments, now holding a 47% market share. Popular 5G models that have gained traction include the Xiaomi Redmi 13C, Apple iPhone 15, Vivo Y28, iPhone 13, and Vivo T3X.

Both offline and online sales channels registered a 4% year-over-year growth, maintaining a stable market share of 51% for offline sales and 49% for online sales. In the online market space, Samsung remains the leader, while Apple has climbed to fourth place thanks to the iPhone 15 being the top-selling smartphone online. In the offline segment, Vivo continues to dominate, with OPPO and Xiaomi taking the second and third places, respectively.

Here’s an overview of how brands have fared in the current market landscape: