- Home

- Managed Services

- Cyber Security

- Blog

- About Us

We 365 Admin Support, just simplify your IT problems

Call for a free support. +91 96666 59505Platform Partnership

- Who We Help

- Shop

- Contact

- News

HIGHLIGHTS

Table of Contents

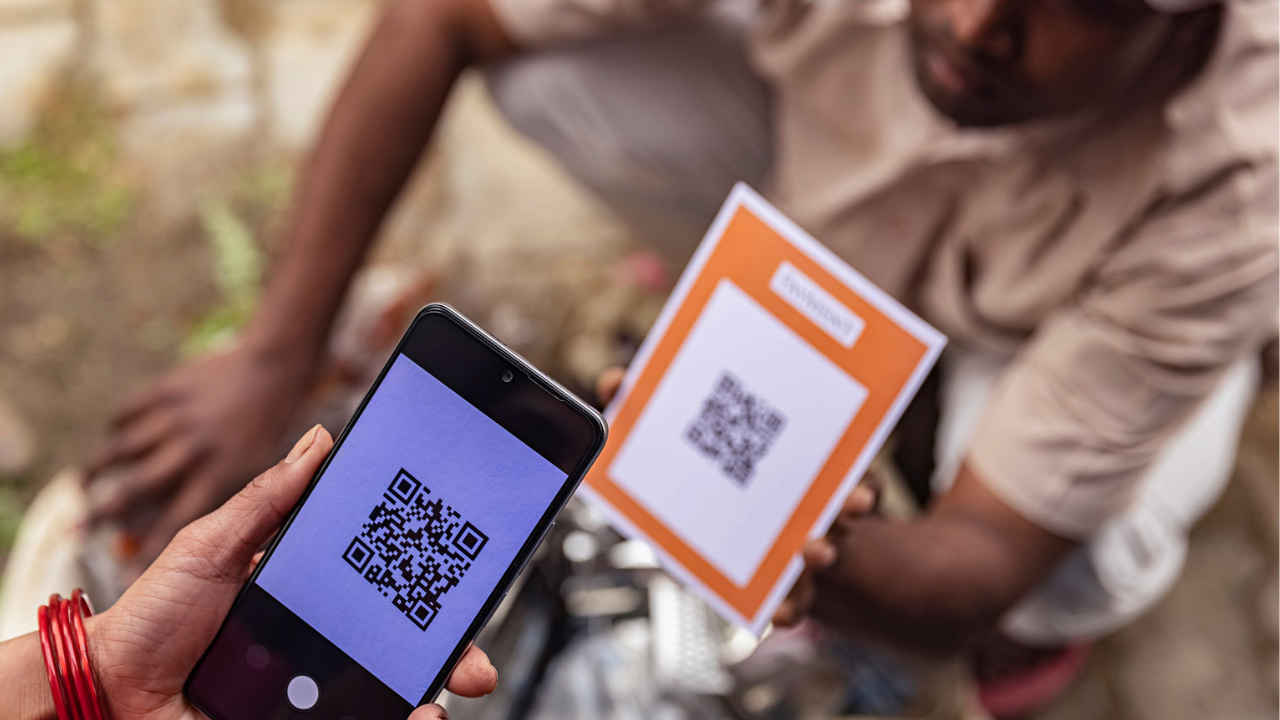

ToggleIn recent years, the Unified Payments Interface (UPI) has emerged as the primary digital payment system in India. In December 2024, transaction volumes soared to an impressive 16.73 billion, reflecting an 8% increase from the previous month. This trend indicates a significant shift in how people prefer to conduct transactions, with many opting for UPI over traditional cash payments, particularly in tier-1 cities across the nation. However, as UPI grows in popularity, it’s essential to ensure that the entire system maintains robust security. With online fraud and scams on the rise, often leveraging UPI for deceptive practices, the National Payments Corporation of India (NPCI) has issued a new circular that all UPI users are required to heed.

If you rely on UPI for your daily transactions like many others, it is vital to be informed about this development. The NPCI has officially stated that effective February 1, 2025, using special characters in UPI IDs will no longer be allowed. Many users currently have IDs that include such characters, and now is the time to correct them. This change is designed to enhance the security protocols of digital transactions and standardize UPI usage across its expanding ecosystem.

The circular released on January 9 clearly specifies that all UPI transaction IDs must adhere to strictly alphanumeric formats. This revised format means that symbols such as @, !, or # will be invalid. Consequently, any transactions made using IDs that contain these special characters will automatically fail. While the majority of banks and payment platforms have already adjusted to this new regulation, NPCI has observed that some entities are still utilizing non-compliant formats.

Given the impending deadline, it’s crucial to take proactive steps to avoid transaction failures. Ensure that your UPI ID is correctly formatted before the February 1 deadline. For instance, an acceptable UPI ID could look like 1234567890oksbi. In contrast, an ID formatted as 1234567890@ok-sbi will not be functional post-deadline.

To check and rectify your UPI ID format, simply open your UPI app. Verify that your ID complies with the new requirements and make any necessary adjustments as soon as possible. Keep in mind that after February 1, any incorrect ID will render payment transactions impossible until you rectify it. Acting now will save you from potential last-minute issues. If you’re unsure about how to proceed, it’s advisable to contact customer support directly for assistance.

These changes are not merely regulatory but are essential to safeguard the interests of UPI users. As digital transactions are already an integral part of our lives, ensuring that they are secure and compliant is of paramount importance. By staying informed and updating your UPI ID promptly, you can continue to enjoy hassle-free transactions without any interruptions.

In conclusion, with UPI transactions only increasing in frequency and importance, it’s critical to adhere to these new guidelines. By ensuring your UPI ID is free from special characters and compliant with NPCI regulations, you’ll not only enhance your transaction security but also encourage a standardization that ultimately benefits all users. Make the necessary changes today to enjoy uninterrupted access to one of India’s most essential digital payment solutions.